Hive Digital Technologies (HIVE) Buzzes Back to Life: Golden Cross Ignites Potential Rally

Hive Digital Technologies Ltd (HIVE) has been a mixed bag for investors in 2024, despite recent bullish signals. While the stock is down 23.69% year-to-date and 2.62% over the past year, a surprise earnings beat in August has sparked renewed interest. HIVE reported a 400% upside surprise, posting quarterly earnings of 3 cents per share, a dramatic turnaround from a loss in the same quarter last year. Sales also saw a significant jump, reaching $32.20 million, exceeding analyst expectations by 32.40%. This strong performance, coupled with a recent bullish technical signal, suggests a potential turnaround for HIVE stock.

Key Takeaways:

- HIVE stock, down significantly in 2024, has seen a recent surge following a surprise earnings beat in Q2 2024.

- The company posted a 400% upside earnings surprise, with sales also exceeding analyst expectations.

- HIVE stock has triggered a Golden Cross, a bullish technical signal that suggests potential upward momentum.

- The stock currently sits above key moving averages, indicating a bullish stance, however, some overbought signals point to potential volatility.

- While the future holds potential for HIVE, investors should remain cautious and monitor the stock closely.

Golden Cross Alert: Is HIVE Stock Ready to Soar?

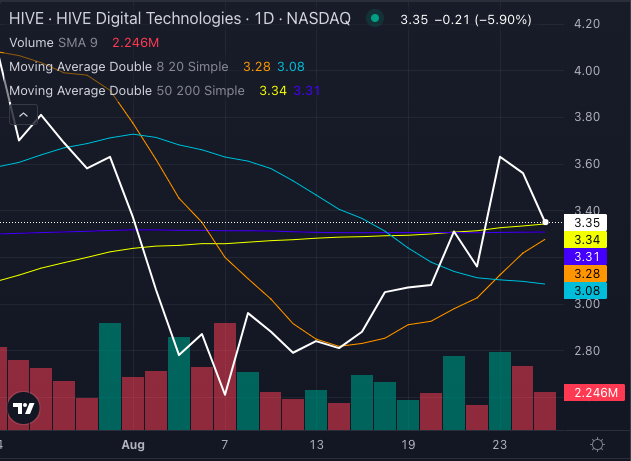

On the technical front, HIVE stock has recently triggered a Golden Cross, a bullish signal that occurs when the 50-day moving average crosses above the 200-day moving average. This pattern, visible on Benzinga Pro charts, signals potential upward momentum, which could spark a rally if sustained.

Chart created using Benzinga Pro

Currently trading at $3.35, Hive’s price sits above several key moving averages, further indicating a bullish stance.

Chart created using Benzinga Pro

This bullish signal is further reinforced as HIVE’s current price is above key moving averages, such as the 8-day SMA at $3.28, 20-day SMA at $3.08, 50-day SMA at $3.34, and 200-day SMA at $3.31.

Read Also: HIVE Digital Technologies Q1 EPS $0.03 Beats $(0.01) Estimate, Sales $32.20M Beat $24.32M Estimate

Moderately Bullish, But Watch For Overbought Signals

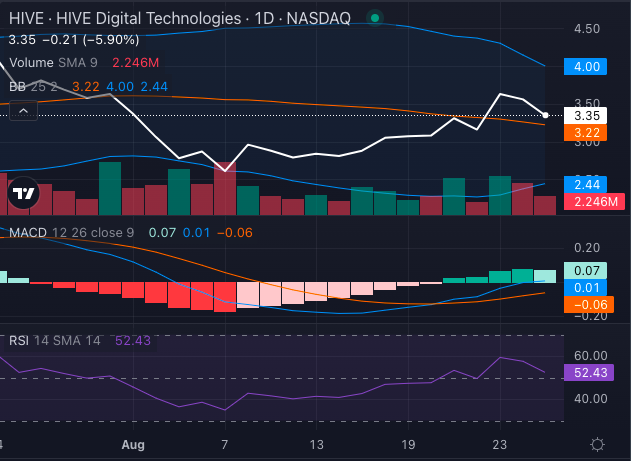

Although the Golden Cross has ignited bullish indicators, the current trend is only moderately bullish with some slight selling pressure evident.

Chart created using Benzinga Pro

The MACD indicator reads at 0.01, a neutral yet positive signal hinting at potential bullish movement. However, caution is warranted as the Relative Strength Index (RSI) is at 52.43, indicating a moderate momentum that is rising, but still comfortably within the neutral range, suggesting that the stock is not yet approaching overbought territory. The Bollinger Bands also suggest a possible squeeze with a range between $2.44 and $4.00, signaling potential volatility ahead.

Cautious Optimism For HIVE Stock Investors

Despite the recent dip in HIVE’s stock price, the earnings beat and the formation of a Golden Cross suggest there could be more upside ahead.

However, investors should be mindful of the overbought signals and prepare for possible short-term volatility. The combination of positive fundamental and technical factors creates a cautiously bullish position for HIVE stock, but investors should monitor the situation closely. Let’s see if HIVE can sustain the buzz!

Read Next:

Photo: rafapress/Shutterstock.com