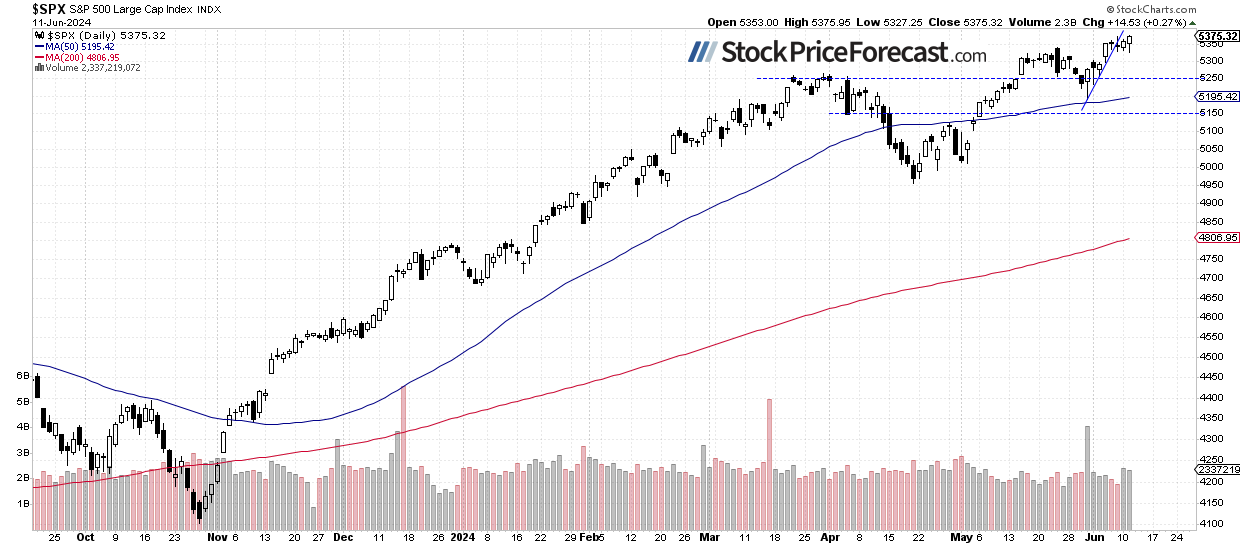

The stock market continued to fluctuate on Tuesday, with the S&P 500 index gaining 0.27% and reaching a new record high of 5,375.95, slightly higher than Friday’s daily high. The market has been led higher by a rally in Apple stock, which gained over 7% on news about implementing AI in their devices.

This morning, futures contracts are pointing to a 0.7% higher opening for the index following the Consumer Price Index (CPI) release. The CPI was slightly lower than expected at 0.0% month over month. Investors are waiting for another important release today – the FOMC Rate Decision at 2:00 p.m. and the Fed Chair Powell Press Conference at 2:30 p.m.

In my forecast for June, I wrote “For the last three months, the S&P 500 index has been fluctuating along new record highs, above the 5,000 level which was broken in February. It looks like a consolidation within a long-term uptrend, but it may also be a topping pattern before some meaningful medium-term correction. What is it likely to do? As the saying goes, ‘the trend is your friend’, so the most likely scenario is more advances in the future.

However, a negative signal would be a breakdown below the 5,000 level. That would raise the question of a deeper correction and downward reversal. I think that the likelihood of a bullish scenario is 60/40 – a downward reversal cannot be completely ruled out. The market will be waiting for more signals from the Fed about potential interest rate easing, plus, at the end of the month, the coming earnings season may dictate the market moves.”

Investor sentiment remained unchanged last week, as indicated by the AAII Investor Sentiment Survey from Wednesday, which showed that 39.0% of individual investors are bullish, while 32.0% of them are bearish (up from last week’s reading of 26.7%). The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 index reached a new record high; however, it remained within a short-term consolidation yesterday, as we can see on the daily chart.

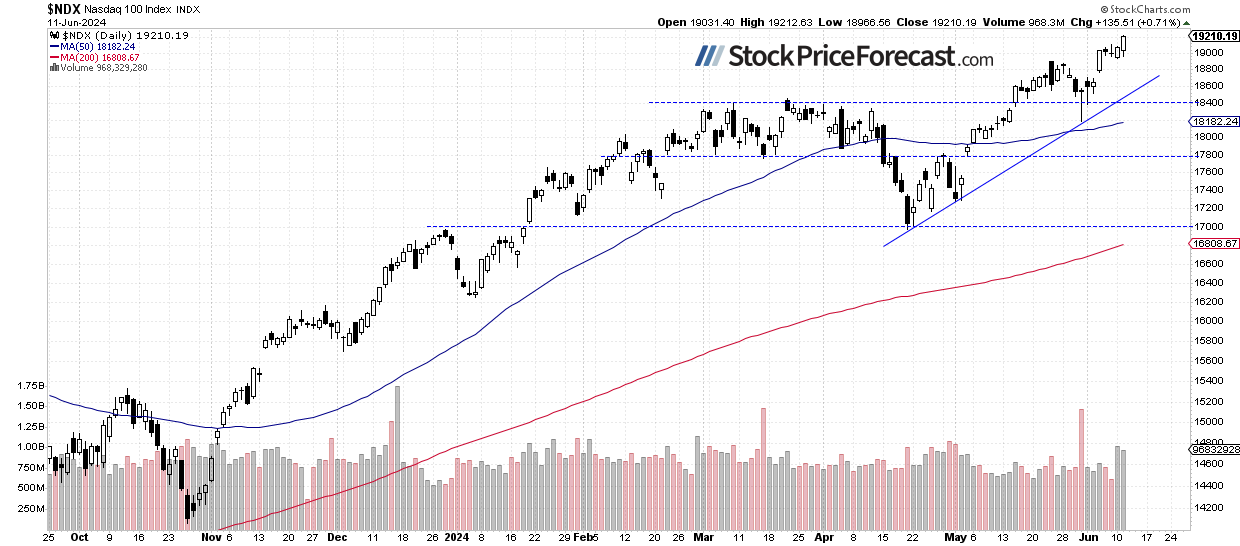

Nasdaq 100 reached new record

The technology-focused Nasdaq 100 index reached a new record high of 19,212.63 yesterday and closed 0.71% higher, led by a rally in Apple stock. This morning, it is likely to open 0.9% higher following the CPI release.

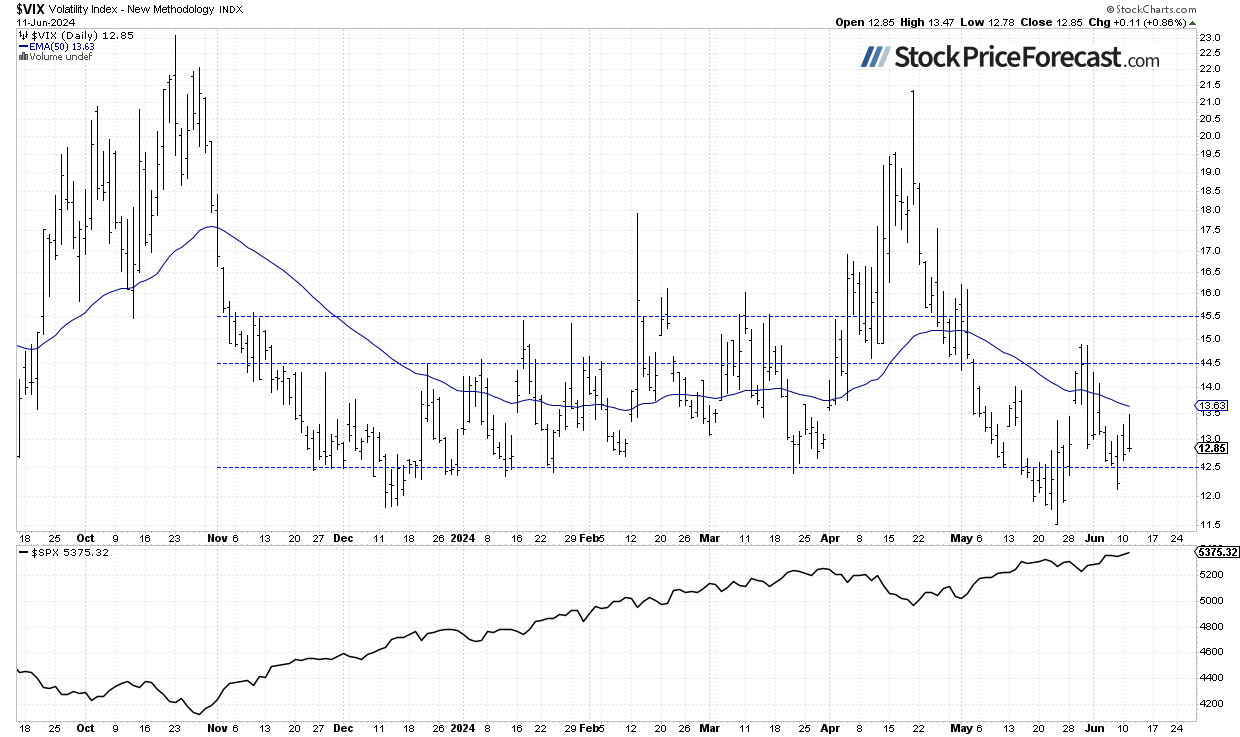

VIX remained close to 13

The VIX index, also known as the fear gauge, is derived from option prices. In late May, it set a new medium-term low of 11.52 before rebounding up to around 15 on correction worries. Last week, the VIX came back lower, and on Friday, it was as low as 12.11, signaling less fear in the market. Yesterday, it remained close to 13 despite advancing stock prices.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

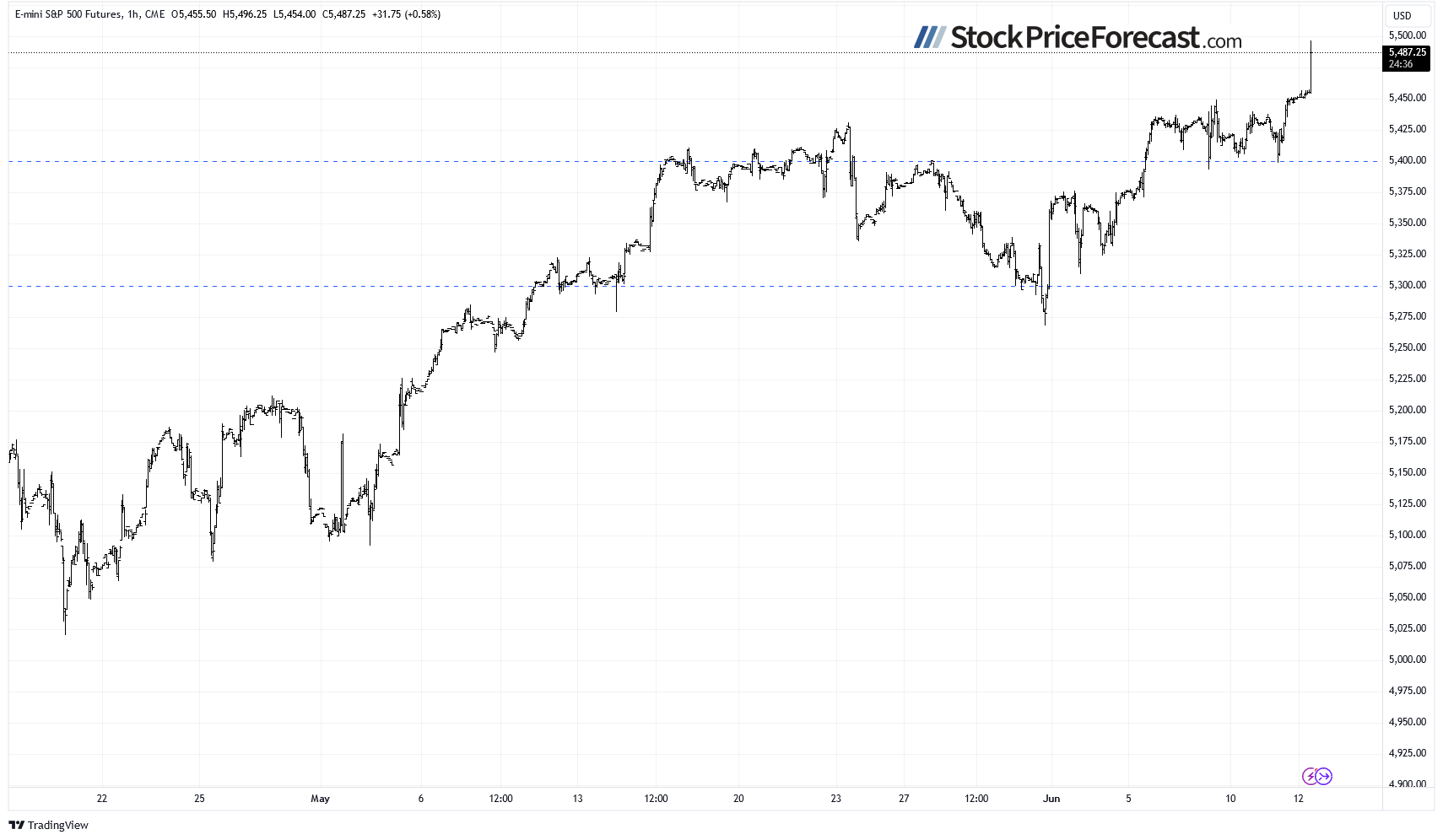

Futures contract accelerating the uptrend

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it is extending a rally on a slightly lower-than-expected inflation number. However, it may see more volatility later in the day as the FOMC news is scheduled at 2:00 p.m. The support level is now around 5,450, and a potential resistance level is at 5,500.

Conclusion

Today, the stock market is likely to open much higher following the CPI data. However, a more pronounced profit-taking action may be coming at some point. Nevertheless, the market is still trading within an uptrend.

Last Friday, I noted “Will the market retrace some of its recent rally? The bearish argument is relatively thin trading, with only a handful of stocks like NVDA, MSFT, or AAPL responsible for the rally. On the other hand, the trend is still upwards, hence further advances are more likely”

For now, my short-term outlook remains neutral.

Here’s the breakdown:

The S&P 500 is likely to extend a record-breaking rally following the CPI release.

Last week, stock prices rebounded and reached new record highs despite mixed data and growing uncertainty.

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!