Posted: July 18, 2023 11:06 a.m. ET

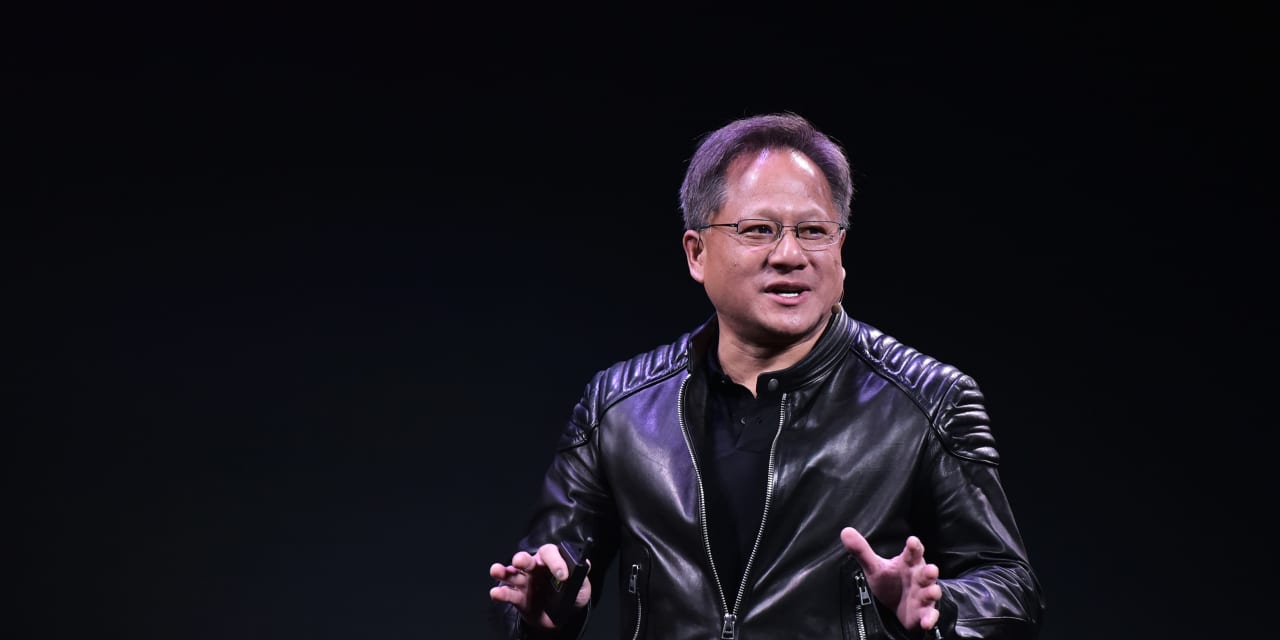

Nvidia Corp. continues to rack up bullish endorsements as analysts eye the vast opportunities ahead for the AI chip leader.

Nvidia NVDA “is the obvious beacon AI company, whose decisions over the past two decades have positioned it for long-term benefits,” wrote Melius Research analyst Ben Reitzes, who kicked off the coverage of the action on Monday evening with a buy rating and a price target of $625. .

THE…

Nvidia Corp. continues to rack up bullish endorsements as analysts eye the vast opportunities ahead for the AI chip leader.

Nvidia

NVDA

“is the obvious flagship AI company, whose decisions over the past two decades have positioned it for long-term benefits,” wrote Melius Research analyst Ben Reitzes, who kicked off the stock coverage. Monday night with a buy rating and price target of $625.

The company reminds him of Apple Inc.

AAPL

“With a comprehensive approach that in our experience tends to generate an outsized profit share in the industry for longer than expected once the ball starts to descend due to developer support and becomes an industry standard. industry.”

See also: Nvidia’s stock could hit $600, Citi says

As Nvidia shares have soared more than 200% so far this year as the now trillion-dollar company has cemented its position on AI in the spirit of Wall Street, Reitzes suggests that potential investors did not miss the boat.

“On the rare occasion when a company like this comes along, we caution investors not to get caught up in (an) arbitrary market capitalization milestone and (instead) focus on long-term sustainable earnings power. term,” he wrote. “Apple also showed us… sometimes the consensus can still be right – and still work when the business model is right.

Read: Nvidia may follow ‘blowout’ outlook with more massive upside, analyst says

Meanwhile, BofA Securities analyst Vivek Arya became more bullish on Nvidia’s stock on Tuesday, raising his price target on the stock to $550 from $500 while maintaining a buy rating. .

The next earnings season could lead to chip stocks diverging between AI “haves” and “have-nots,” and Arya likes Nvidia’s stock setup even more in this scenario.

“Coming quarters may see greater dispersion among chip stocks based on actual versus overstated/perceived AI benefits,” Arya wrote on Tuesday, calling Nvidia a player that “can maintain dominance. “. He expects the company to retain a 75-80% share of the accelerator market.

More from MarketWatch: Cloud services from Amazon, Microsoft and Google are big on AI, but do their customers even want it?

Arya noted that Nvidia’s server accelerators are essential for handling intensive AI workloads and that the market opportunity is still ripe, as only around 10% of cloud servers are currently “accelerated”, adding that ” we are only in the early stages of investing in AI.” .”

He also pointed out that Nvidia hosts other AI products, including networking and software offerings that can help customers position themselves in the AI world.

Read: AMD may suffer from high expectations – but Wells Fargo is preparing for Intel’s setup