Companies in the Semiconductor – General industry are at the forefront of the ongoing technological revolution based on HPC, AI, electrified and automated driving, IoT and so forth. The semiconductors they produce enable the cloud to function and help analyze the data into actionable insights that can be used by companies to operate more efficiently.

Despite negative forecasts from economists and market watchers alike, 2023 has turned out to be much stronger than initially expected. It is now clear that a recession, if any, will be mild.

Semiconductor growth forecasts reflect the positive outlook. According to the latest data coming out of WSTS, which is also typically quoted by the Semiconductor Industry Association (SIA), global semiconductor sales will decline 9.4% this year (previous forecast was a decline of 10.3%). Moreover, it will be followed by 13.1% growth in 2024.

Gartner has raised its estimates from an 11.2% decline to a 10.9% decline this year. It is also more optimistic about 2024, with current projections at 16.8% growth. The main driver is the memory segment, where excess inventory is depressing prices this year and resultant production cuts are expected to lead to shortages, and therefore price increases next year, according to DIGITIMES Research. IDC is perhaps the most optimistic, projecting 20.4% growth in 2024.

As far as end-markets are concerned, growth in PCs and smartphones will come from new AI-enabled versions starting next year. PC growth will also be driven by the end of support for Windows 10. Commercial and enterprise deployment should also increase as a soft-landing for the economy looks increasingly likely.

Driven by Internet connectivity across the developed and developing worlds and supportive technology such as sensor networks and AI adoption, the IoT market is also expected to grow steadily over the next few years. Future Market Insights expects the industrial IoT segment alone to grow at a 12.1% CAGR between 2023 and 2033.

Auto electrification, structural changes in industrial automation, data center strength, generative AI and custom chips for cloud services are expected to drive multi-year growth in semiconductors. While in the past, memory demand has been tied to PCs and servers, which is the main reason for the pandemic-related imbalance in 2023, auto and server applications will accelerate in the coming years.

The government’s target of reducing dependence on China, and onshoring projects with national security implications will shape the future of this industry.

As the outlook has turned rosier through this year, share prices have also soared, leading to rich valuations. Despite this, companies like NVIDIA Corporation and Intel Corporation are worth buying.

About the Industry

The companies grouped under the Semiconductor – General category produce a broad range of semiconductor devices, both integrated and discrete, like microprocessors, graphics processors, embedded processors, chipsets, motherboards, wireless and wired connectivity products, DLPs and analog, serving multiple end markets. It includes companies like NVIDIA, Texas Instruments, Intel and STMicroelectronics.

Major Themes Shaping the Industry

- The long-term outlook for the industry has been robust for a while now because of its being on the building-block side of technology, which makes it crucial for the proliferation of the Internet and the ongoing digitization of every aspect of life. However, throughout this year, the short-term outlook has continued to brighten. With interest rates stabilizing and demand side factors such as the surging inflation coming under control, we can finally focus on industry-specific issues. These too are looking up with the inventory imbalance corrected, AI-enabled end-point devices coming to market next year and surging infrastructure demand stemming from the rapid adoption of generative AI. While global economies are only gradually returning to normal and geopolitical concerns can’t be ruled out, a very definite turn for the better is visible.

- There is continued strength in emerging areas like AI and machine learning, IoT, and automotive. ReportLinker expects the AI chip market to grow at a CAGR of 34.5% between 2023 and 2028. Mordor Intelligence expects the IoT chip market to grow at a 14.7% CAGR between 2023 and 2028. Automotive electronics is another area of evolving needs with increasing electronics (including ADAS), safety enhancements and transition to electrified power trains being important drivers. Grand View Research estimates the auto chip market to generate an 8.1% CAGR from 2023 to 2030, which it attributes primarily to increasing penetration of electronic components in luxury to mass-produced cars, increasing adoption of electronic control unit (ECU) in modern vehicles and the growing focus on safety systems in vehicles. Infotainment, fuel efficiency and safety are expected to be the primary drivers as the world moves toward EVs and hybrids. Automation and robotics, with increasing adoption across industrial operations, are other areas of growth. These strong end-markets will drive continued demand for semiconductor components for years to come.

- Semiconductor supply chains are adjusting. Semiconductor supply chains have become increasingly efficient over the years. While this has brought down costs, the just-in-time model has made the supply chains relatively unreliable in case of external disruptions, as happened during the pandemic, or when China imposed its zero tolerance COVID shutdowns. This, along with the other factors, are leading semiconductor companies to diversify their supply chains and reduce their dependence on China. This is an ongoing process that will take several years. In the meantime, there is a growing concern that all the most important leading-edge chips are currently made in Taiwan, a country that China continually threatens to annex. Since this has national security implications, there is an ongoing drive to onshore manufacturing. The $52 billion infusion from the CHIPS Act will help.

Zacks Industry Rank Indicates Strong Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank #23, which places it in the top 9% of the 250 odd Zacks-classified industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates that near-term prospects are good. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of 2 to 1.

An industry’s positioning in the top 50% of Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is relatively strong. The opposite is true for stocks in the bottom 50% of industries. In this case, the aggregate earnings estimate for 2023 is up 28.1% from the year-ago level while the aggregate earnings estimate for 2024 is up 59.4% from last year.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Stock Market Performance Improving

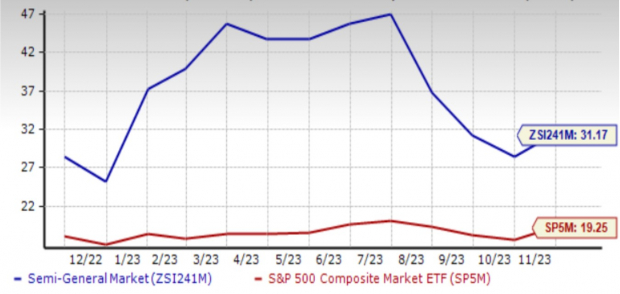

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has traded at a premium to both the broader Zacks Computer and Technology Sector and the S&P 500 index since January, and pulling further ahead in May.

The industry has gained 107.4% over the past year. The broader technology sector gained 33.0% while the S&P 500 index gained just 12.0%.

One-Year Price Performance

Image Source: Zacks Investment Research

Current Valuation Rich

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry is currently trading at 31.38X, which is a 15.4% discount to its median value of 37.08X over the past year. Additionally, the S&P 500 trades at 19.23X while the sector trades at 24.63X. Therefore, the industry appears overvalued in comparison.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

2 Stocks to Consider

Given the turnaround over the past year, this industry is beginning to look really good. Additionally, since it consists of several technology heavyweights that are the backbone of how computing is done these days, there is more reason to be optimistic. The stocks discussed below carry a Zacks #1 (Strong Buy) rank.

NVIDIA Corp. (NVDA): Santa Clara, CA-based NVIDIA provides graphics, and compute and networking solutions in the U.S., Taiwan, China and other markets. Its graphics processing units (GPUs) are the most popular in the gaming segment. NVIDIA is also at the leading edge of enterprise, data center, cloud and automotive deployments today.

Generative AI is driving exponential growth in compute requirements. Because NVIDIA’s accelerated computing is versatile, energy-efficient and has low total cost of ownership, companies are rapidly transitioning to its products to train and deploy AI. NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines.

They are opening up opportunities and leading to broad-based growth across geographies and markets. The automotive, financial services, healthcare and telecom verticals are particularly strong, as AI and accelerated computing are quickly becoming integral to customers’ innovation road maps and competitive positioning.

NVIDIA is also seeing momentum across all its segments, which is evident from the strong sequential growth in the last quarter. With inventory corrections in gaming and professional visualization in the rearview mirror, the company is now positioned to benefit from its operating leverage.

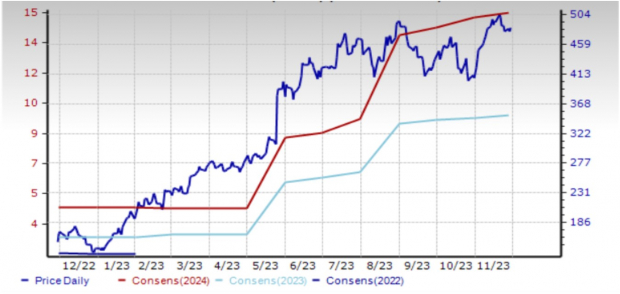

The Zacks Consensus Estimate for fiscal 2024 (ending January) is up 37 cents (3.4%) in the last 30 days and up 62 cents (3.8%) for the following year.

The stock is up 209.3% in the past year.

Price & Consensus: NVDA

Image Source: Zacks Investment Research

Intel Corp. (INTC): Intel, the world’s largest semiconductor company, provides platform products, such as central processing units and chipsets, and system-on-chip and multichip packages, as well as a broad range of other products including computing, connectivity, memory, storage, HPC, etc. It serves original equipment manufacturers, original design manufacturers, cloud service providers and other equipment manufacturers across one of the broadest ranges of end markets.

Intel is executing on its foundry strategy, which is growing strongly off a small base. It is making progress on its process and product roadmaps and seeing momentum in its AI everywhere strategy. Expense control and operating leverage are helping the contracting bottom line.

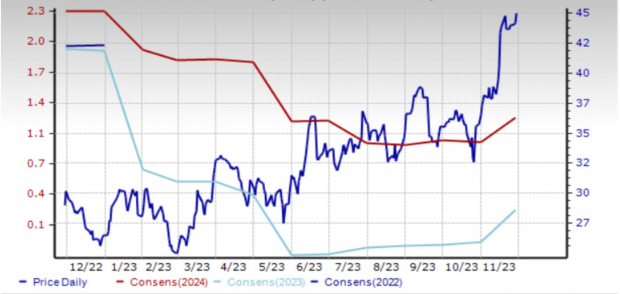

Intel beat the Zacks Consensus Estimate by 95.2% in the last quarter. In the last 30 days, the current year EPS estimate increased 8 cents (9.2%). The 2024 estimate increased 6 cents (3.3%).

The shares of the company have appreciated 55.8% over the past year.

Price & Consensus: INTC

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Intel Corporation (INTC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.