April 20, 2024 1:28 AM | 2 min read |

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

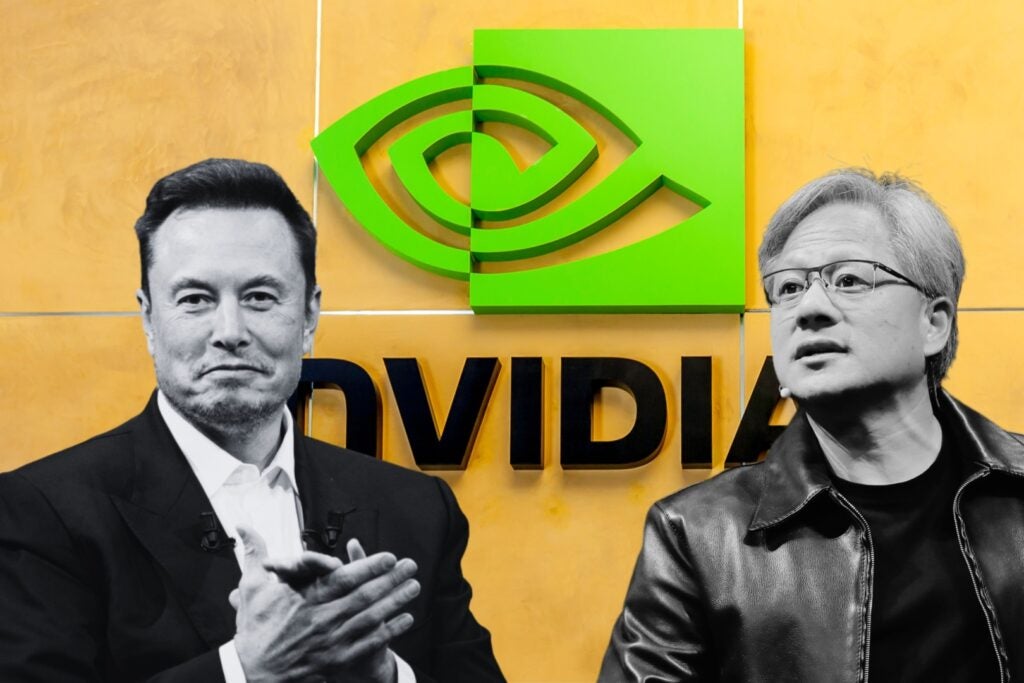

Tesla Inc. CEO Elon Musk ridiculed the sharp 10% decline in Nvidia Corp.’s (NASDAQ:NVDA) stock and its subsequent $211 billion market capitalization loss on Friday.

What Happened: Musk took to X, formerly Twitter, on Friday to mock the substantial decline in Nvidia’s market capitalization. He referred to the 10% decline as “rookie numbers.”

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you’ll also get Benzinga’s ultimate morning update AND a free $30 gift card and more!

On Friday, Nvidia’s stock took a significant hit, resulting in a $211 billion loss in market capitalization. This was the second-largest single-day loss in the history of the U.S. stock market.

See Also: Tesla’s Autonomous Driving Efforts Win Praise From Goldman Sachs

Overall, the Magnificent 7 group of stocks, which includes Apple Inc., Alphabet Inc.’s Google, Microsoft Corp., Meta Platforms Inc., Amazon.com Inc., Tesla and Nvidia together witnessed a record $950 billion loss of market capitalization in the last week, according to MarketWatch.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The decline in Nvidia’s stock value has had a significant impact on the market.

FREE REPORT: How To Learn Options Trading Fast

In this special report, you will learn the four best strategies for trading options, how to stay safe as a complete beginner, a 411% trade case study, PLUS how to access two new potential winning options trades starting today.Claim Your Free Report Here.

The tech-heavy Nasdaq 100 index experienced its worst day since late 2023, and the worst week since late 2022, with a 2.1% drop on Friday. This marked the fourth consecutive week of declines, a negative streak not seen since May 2022.

On a weekly basis, the Nasdaq 100, which is closely tracked by the Invesco QQQ Trust (NASDAQ:QQQ), tumbled 5.3%, marking its worst performance since October 2022. The downturn on Friday further exacerbated the already pessimistic sentiment surrounding U.S. tech stocks.

Nvidia’s stock decline was attributed to a series of events, including worse-than-expected earnings from ASML Holdings N.V. (NASDAQ:ASML) and a reduced outlook for the chip market by Taiwan Semiconductor Manufacturing Company Ltd. (NYSE:TSM).

Despite the stock decline, TSM’s revenue surged 16.5% to $18.87 billion, surpassing the Street consensus estimate of $18.40 billion. This was attributed to robust demand from artificial intelligence firms.

Other companies in the semiconductor sector, such as Super Micro Computer, Inc. (NASDAQ:SMCI), also experienced stock declines on Friday, further adding to the overall negative sentiment in the market.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image created via photos on Shutterstock

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.