- DOGE’s price increased by double digits in the last week.

- Technical indicators hinted at the possibility of a price swing in either direction.

Leading meme coin Dogecoin [DOGE] may experience headwinds this week as volatility markers hinted at the possibility of significant short-term price swings.

At press time, DOGE was trading at $0.207. According to CoinMarketCap’s data, its price has increased by 20% in the last week.

However, with rising volatility in its market, the meme coin may shed some of these gains.

Price swings on the horizon

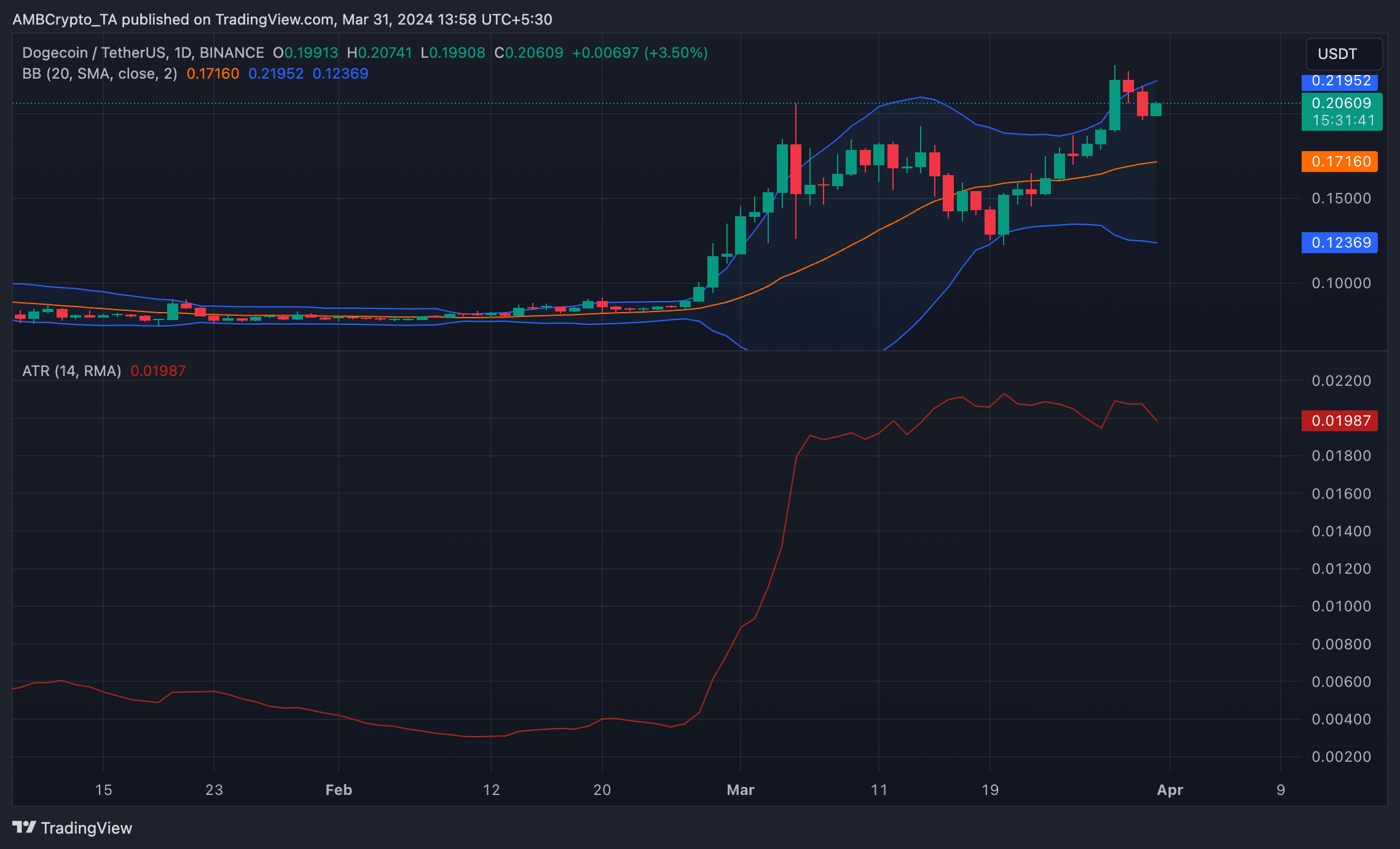

AMBCrypto assessed the coin’s Bollinger Bands (BB) on a one-day chart and found that the gap between the indicator’s upper and lower bands has steadily widened since the 27th of March.

This indicator gauges an asset’s market volatility and potential price movements. When the gap between its lower and upper bands widens, it indicates an increase in volatility.

The gap may widen for several reasons, one of which is increased trading volume. According to Santiment’s data, DOGE’s trading volume climbed to a weekly high of $7 billion on the 28th of March.

During periods of band expansion, traders are on the lookout for price breakouts in either direction.

Further confirming the possibility of a market swing, the value of DOGE’s Average True has risen by 5% in the past three days.

This indicator measures market volatility by calculating the average range between high and low prices over a specified number of periods.

When it rises in this manner, it suggests that the price swings are becoming more significant.

The bulls remain in control

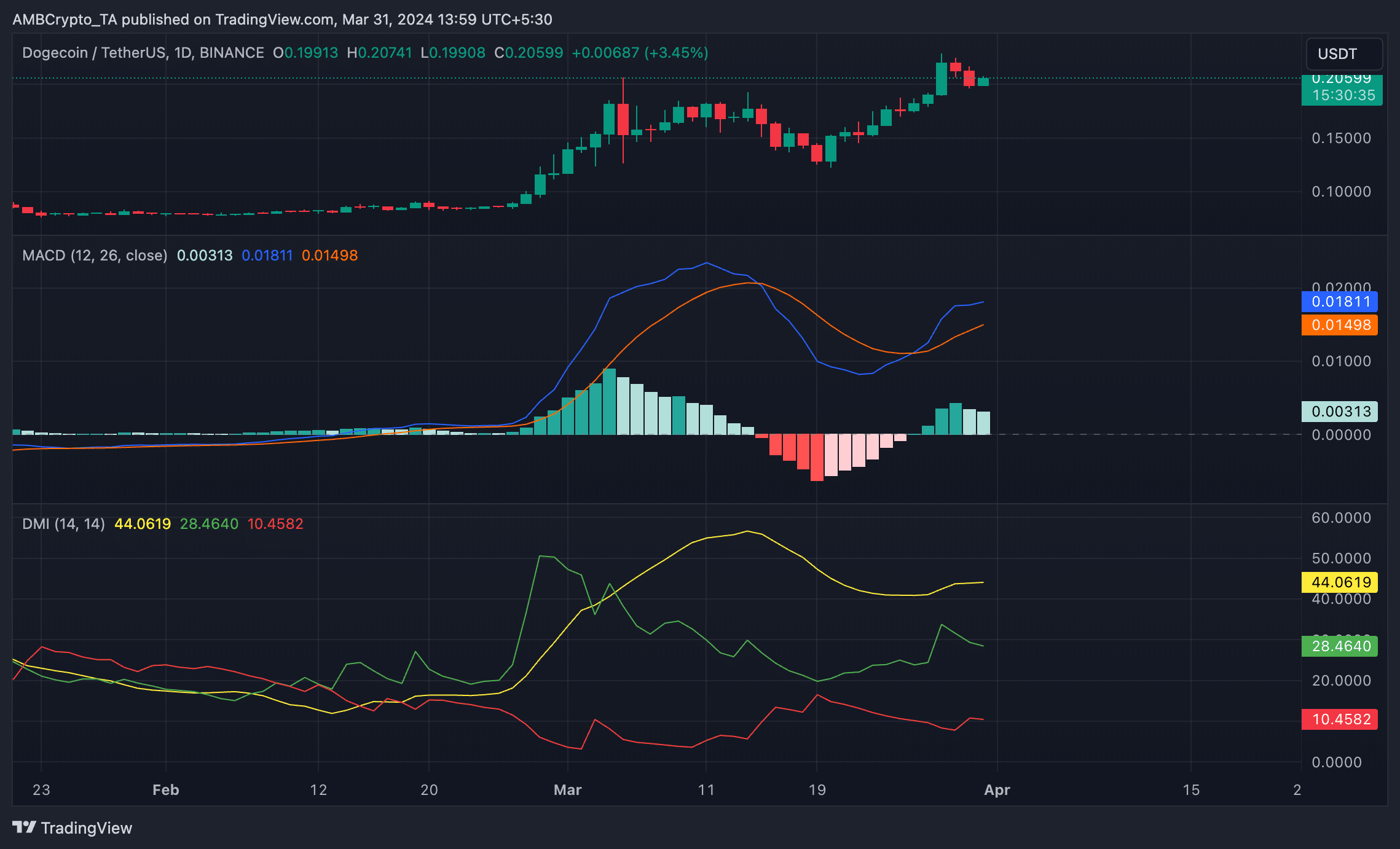

While volatility markers hint at the possibility of price swings in the coming days, DOGE’s Directional Movement Index (DMI) and Moving Average Convergence/Divergence indicators showed that bullish sentiments exceeded bearish activity.

Readings from the coin’s Directional Movement Index (DMI) showed the positive directional index above the negative index.

When these lines are positioned this way, it means that the strength of the prevailing bullish trend is higher than the strength of any potential downward price movement.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Likewise, DOGE’s MACD line crossed above the signal line on the 26th of March and has since been positioned this way.

An upward intersection of the MACD line with the signal line is a bullish sign, often indicating a rise in buying pressure.