- MATIC’s price fell by more than 7% in the last 24 hours

- Metrics hinted at a further drop in its price soon

MATIC has disappointed its investors significantly with its price action lately. However, while bears took control of the altcoin’s price on the charts, Polygon’s performance in the DeFi space looked commendable. Hence, the question – Can the latter help initiate a trend reversal for MATIC?

Polygon’s recent setback

CoinMarketCap’s data revealed that MATIC’s price depreciated by over 5% in the last seven days. However, it soon got worse as the altcoin lost another 7% of its value in the last 24 hours alone. At the time of writing, MATIC was trading at $0.6622 with a market capitalization of over $6.5 billion, making it the 18th largest crypto.

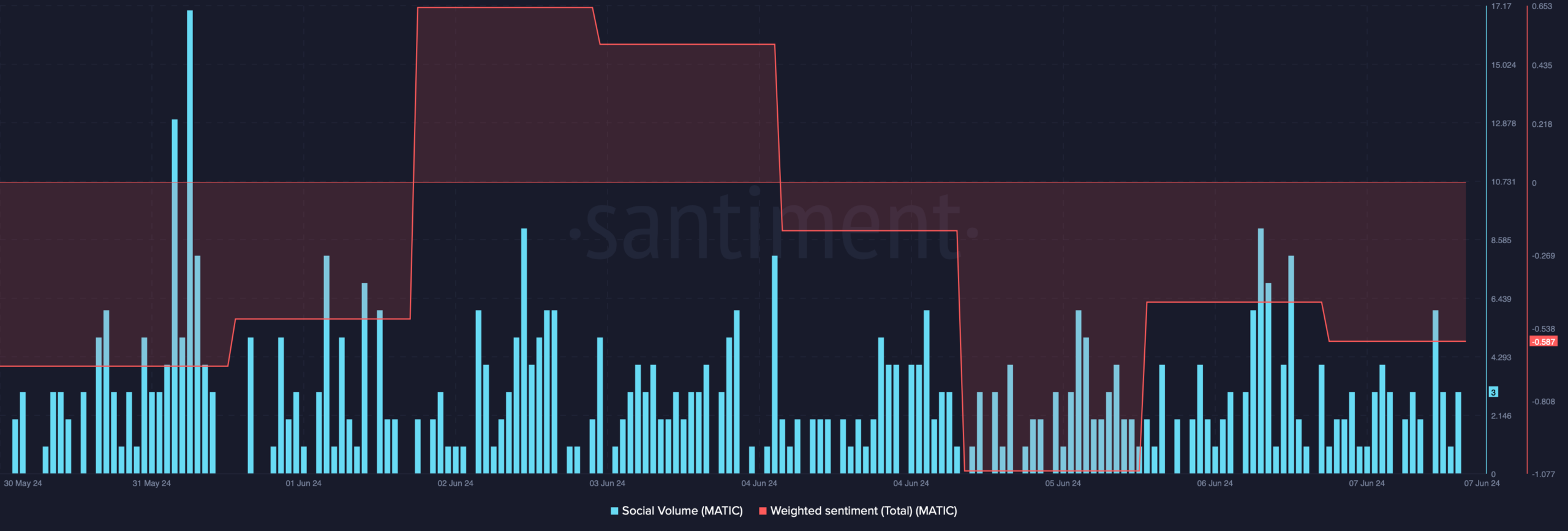

The price decline also had an impact on the token’s social metrics. For instance, its social volume dropped, reflecting a dip in its popularity. Its weighted sentiment also remained in the negative zone – A sign that bearish sentiment retained its dominance in the market.

The worst news was that while the token’s price dropped, its trading volume increased. This legitimized the price decline and indicated that the chances of the trend continuing were high.

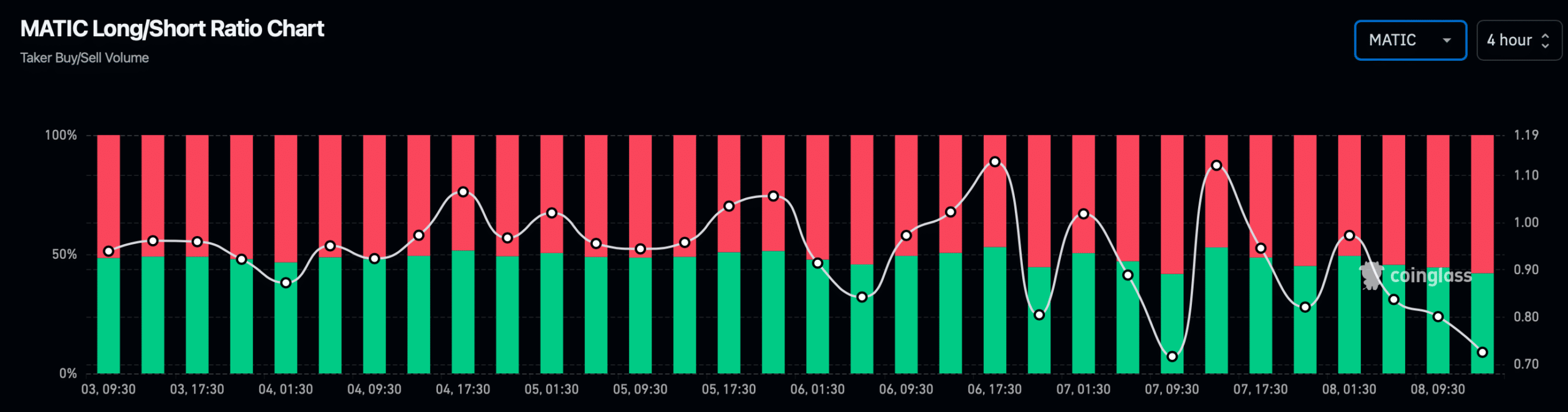

On top of that, AMBCrypto’s look at Coinglass’ data revealed that the altcoin’s long/short ratio dropped over the last 4 hours. A low ratio is a sign of bearish sentiment, one where there is more interest in selling or shorting assets.

And the good part is…

While the token’s price dropped, Polygon shared a tweet highlighting the blockchain’s performance in the DeFi space. According to the same, Polygon PoS, zkEVM, and CDK have emerged as top choices for DeFi builders, providing developers with scalable networks and tools to build financial solutions.

Aave was the largest DeFi protocol on Polygon by total value locked with a value of $460 million. Azuro protocol was introduced to EVM chains supporting prediction app ecosystems. Within just 14 months on Polygon, Azuro now boasts 25+ live apps, $300 million in volume, and over $3.2 million in revenue.

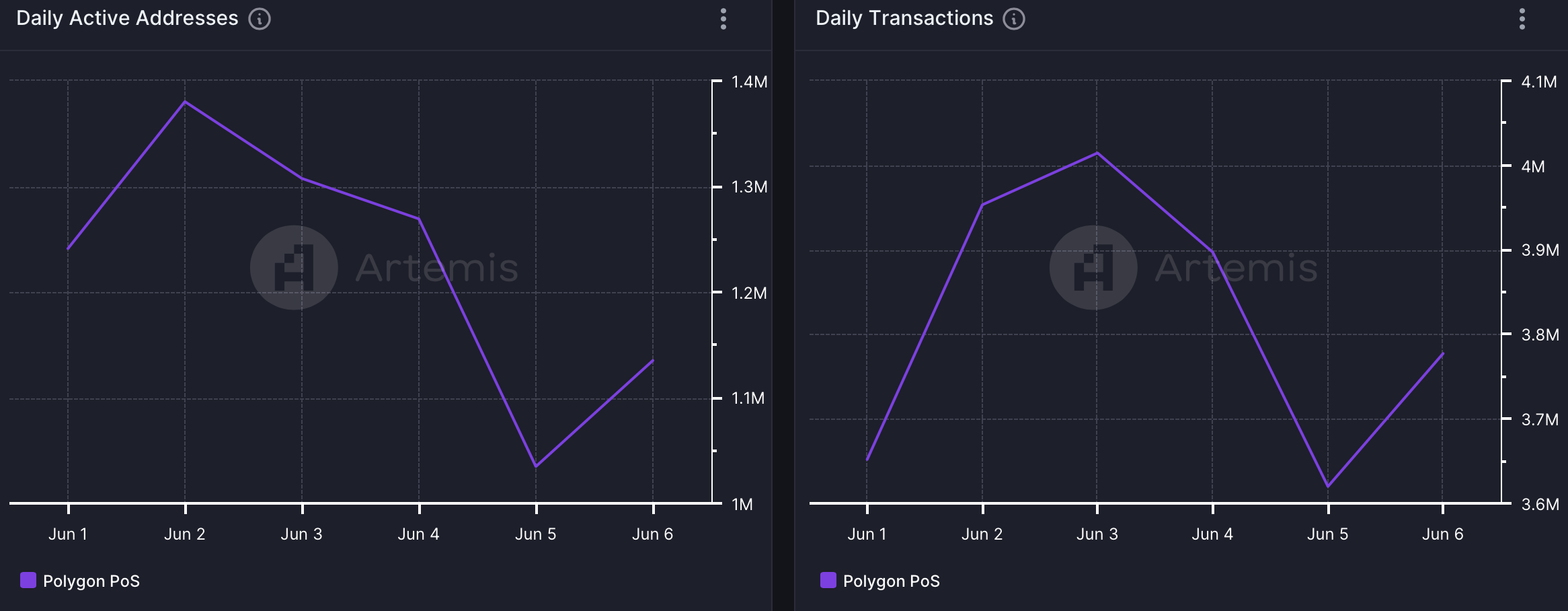

And yet, despite having such strong pillars in the DeFi space, Polygon’s network activity dropped last week.

Realistic or not, here’s MATIC’s market cap in ETH terms

Finally, AMBCrypto’s analysis of Artemis’ data revealed that MATIC’s daily active addresses dropped too. Thanks to the same, the blockchain’s daily transactions fell over the last 7 days.

What this means is that while Polygon’s DeFi performance has been commendable, if not perfect, it’s not yet enough to guide MATIC’s value to bullish territory on its own. Hence, the altcoin’s market trend is likely to persist for now.