Jerod Harris/Getty Images Entertainment

Thesis

In light of the comprehensive evaluation of Advanced Micro Devices, Inc. (NASDAQ:AMD) financial prospects and its position in the dynamic semiconductor industry, it is evident that the company is currently undervalued. As per my analysis, AMD exhibits compelling growth potential, having surged from $9.7 billion in 2020 to a robust $21.8 billion in revenue by 2023, signifying a remarkable annual growth rate of 21%. This growth trajectory, while not devoid of challenges like fluctuating margins and potential industry downturns, hints at AMD’s promising future.

With the weight of various valuation models pointing toward an enticing 18.8% upside, or potentially even higher, setting a price target of $120.6, it becomes evident that AMD is positioned for substantial returns. As such, I wholeheartedly recommend AMD as a “strong buy,” recognizing its solid financial foundation and the potential for investors to reap significant rewards.

Overview

In attempting to predict AMD’s near future, it is essential to consider the semiconductor cycle. This cycle essentially revolves around the periodic replacement of CPUs and GPUs, leading to spikes in revenue for companies. However, once these components have all been replaced, revenues tend to decline. Over the long term, though, revenue generally trends upward. The onset of the downside is typically anticipated by monitoring inventories.

As evident in the table below, sourced from the Semiconductor Industry Association, the semiconductor market appears to be recovering from a recent revenue drop. Nevertheless, this recovery might be temporary. In the near future, we anticipate another decline in revenue, possibly due to consumers avoiding unnecessary purchases. As discussed in my article about Taiwan Semiconductor Manufacturing Company Limited (TSM), a significant portion of its revenue is derived from consumer electronics. AMD is no exception; in fact, its dependence on individual consumers may be as high as 60%. We will delve deeper into this aspect in the second valuation model.

TSMC Q2 2023 Semiconductor Industry Association

Segments

AMD operates in various segments, but across all of them, AMD sells CPUs or GPUs. As illustrated below, AMD offers GPUs for the data center market, CPUs and GPUs for consumers and PC brands, and the same applies to video game consoles. Additionally, AMD supplies embedded microprocessors found in cars, aircraft, and household appliances.

Leadership Products (Investors’ Presentations)

Data Center Market

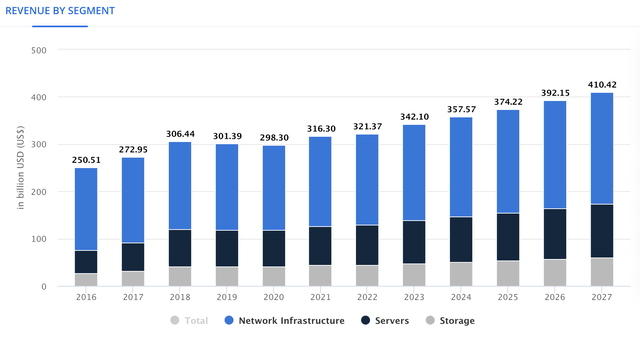

The Data Center Market is poised for consistent revenue growth, with a projected CAGR of 4.66% from 2023 to 2027. However, inside this data center market is the “AI Market,” which has been delivering huge returns so far.

Data Center Market Revenue Projections (Statista)

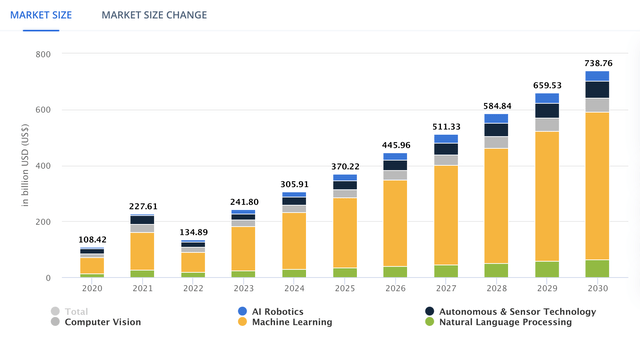

The AI market is set to undergo robust expansion, with an expected CAGR of 17.30% from 2023 to 2030. It’s noteworthy that by 2030, an estimated 70% of companies will integrate AI into their operations, representing a substantial 35% increase from the 35% observed in 2023.

AI Market – Worldwide (Statista)

Client & Embedded processors

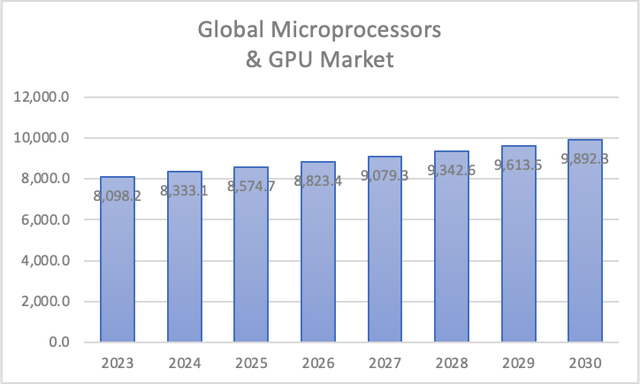

This segment encompasses AMD’s sales of CPUs and GPUs to individuals and PC brands. The microprocessor and GPU market is anticipated to grow at a rate of 2.9% through 2030.

Author’s Calculations with base on Yahoo

Gaming GPU Market

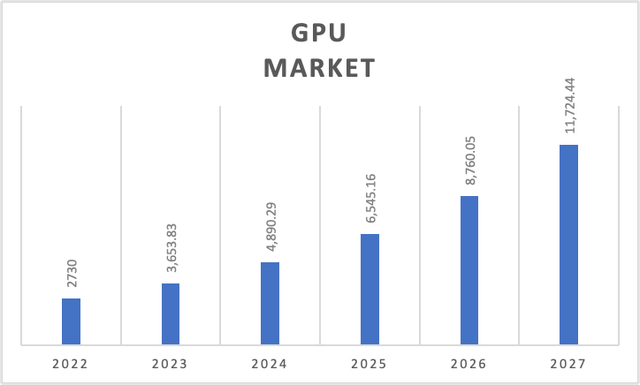

In the gaming market, AMD offers GPUs, and this market is expected to experience a growth rate of 33.8% through 2027. This growth rate is supported by various sources, including Mordor Intelligence, Allied Market, and Yahoo.

Author’s Calculations with base on Many Sources

Financials

AMD, like many of the stocks I’ve recently covered, has experienced significant growth during the pandemic period, with revenue increasing from $9.7 billion in 2020 to $21.8 billion in 2023, representing a remarkable 21% annual growth rate.

However, as you may have noticed, revenue was growing at a pace of 9.61% from 2017 to 2019, and during the period of 2022-2023, revenue dropped by approximately 7.6%. This decline could be attributed to the previously mentioned semiconductor cycle.

AMD’s profit margins have taken a hit, dropping from heights of over 20% to slightly negative territory. Currently, the operating income margin stands at -1.73%, and the net income margin is at -0.11%.

As indicated in the table below, these negative margins are a result of the reduction in revenue and an increase in total operating expenses. However, if AMD maintained the 2023 trailing twelve months [TTM] gross profit while keeping the total operating expenses from 2022, AMD would still have a modest operating income of $144 million, representing a 0.6% margin, albeit a small one.

Seeking Alpha Author’s Calculations

AMD’s balance sheet is in excellent condition, boasting cash reserves more than sufficient to cover its entire debt load. As illustrated in the table below, AMD holds cash reserves of $6.2 billion and a total debt of $2.8 billion.

AMD’s free cash flow is adequate to bolster its cash reserves and offset the net income loss. However, it has seen a decrease of $1.065 billion since 2022.

The free cash flow margin has been steadily declining since 2020, when it stood at 20.8%, and now it’s at 10.4%. As indicated in the “FCF Components” table, the reduction in free cash flow (“FCF”) is primarily attributed to a decrease in cash from operations, rather than increased expenses such as CapEx.

Overall, AMD maintains a robust balance sheet and a sufficient free cash flow margin to continue expanding its cash reserves and servicing debts. Nevertheless, its margins have been on a downward trajectory since peaking in 2020-2021.

Valuation

In this valuation, I will present two models: one based on analysts’ estimates available here on Seeking Alpha, and the other based on my own estimates.

In the table below, I will calculate depreciation and amortization (D&A), interest expenses, and CapEx with margins linked to revenue. Additionally, I will derive the WACC using a well-known formula.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 55,136.00 |

| Debt Value | 2,860.00 |

| Cost of Debt | 3.60% |

| Tax Rate | 92.28% |

| 10y Treasury | 4.80% |

| Beta | 1.6 |

| Market Return | 10.50% |

| Cost of Equity | 13.92% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | (299.00) |

| D&A | 3,574.00 |

| CapEx | 530.00 |

| Capex Margin | 2.42% |

| Assumption Part 3 | |

| Net Income | -25.00 |

| Interest | 103.00 |

| Tax | -299.00 |

| D&A | 3,574.00 |

| Ebitda | 3,353.00 |

| D&A Margin | 16.34% |

| Interest Expense Margin | 0.47% |

| Revenue | 21,876.0 |

Analysts’ Estimates

In the first model, I will assume that AMD can achieve the growth rates expected by analysts, which are 18.48% for revenue and 30.65% for net income.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $21,788.5 | $1,862.92 | $2,127.64 | $5,687.34 | $5,789.93 |

| 2024 | $25,311.2 | $2,164.11 | $2,471.63 | $6,031.33 | $6,133.92 |

| 2025 | $29,785.9 | $2,546.69 | $2,908.58 | $7,774.86 | $7,915.10 |

| 2026 | $35,504.8 | $3,035.66 | $3,467.03 | $9,267.64 | $9,434.81 |

| 2027 | $42,854.0 | $3,664.02 | $4,184.67 | $11,185.96 | $11,387.73 |

| 2028 | $52,344.3 | $4,475.44 | $5,111.40 | $13,663.17 | $13,909.63 |

| ^Final EBITA^ |

As you can see, according to analysts, AMD could deliver impressive returns. In the near term, the stock could adjust to a fair value of $126.1, which is 24.2% higher than the current stock price of $101.5. Looking further ahead, a future value of $240.2 suggests that the stock could offer annual returns of 27.3%, which is quite attractive.

My Estimates with a net income margin of 8.55%

The first step in this analysis is to determine the revenue distribution across AMD’s various segments. Taking into account the “Six months ended July 1, 2023” data, we find that 24.4% of revenue comes from data centers, 16% from clients, 31% from gaming, and 28.2% from embedded. It’s evident that, in terms of future growth prospects, data center revenue is of utmost importance.

| Data Center | Client | Gaming | Embedded | |

| 2023 | 5,337.7 | 3,500.2 | 6,781.6 | 6,169.0 |

| 2024 | 6,287.9 | 3,601.7 | 9,073.7 | 6,347.9 |

| 2025 | 7,407.1 | 3,706.1 | 12,140.6 | 6,532.0 |

| 2026 | 8,725.6 | 3,813.6 | 16,244.2 | 6,721.5 |

| 2027 | 10,278.7 | 3,924.2 | 21,734.7 | 6,916.4 |

| 2028 | 12,108.3 | 4,038.0 | 29,081.1 | 7,116.9 |

I will sum up all the results from the table above and assume a net income margin of 8.55%, which is higher than what is currently expected.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $21,788.5 | $1,047.87 | $1,196.78 | $4,756.48 | $4,859.07 |

| 2024 | $25,311.2 | $1,314.96 | $1,501.82 | $5,061.52 | $5,164.11 |

| 2025 | $29,785.9 | $1,706.52 | $1,949.02 | $6,815.30 | $6,955.55 |

| 2026 | $35,504.8 | $2,243.31 | $2,562.09 | $8,362.70 | $8,529.87 |

| 2027 | $42,854.0 | $2,986.04 | $3,410.35 | $10,411.64 | $10,613.42 |

| 2028 | $52,344.3 | $4,022.30 | $4,593.87 | $13,145.65 | $13,392.10 |

| ^Final EBITA^ |

According to this second model, AMD could potentially deliver stronger returns. In the near term, the stock could reach a fair value of $129.9, marking a 28% increase from the current stock price of $101.5. Further into the future, a projected value of $248.2 suggests that the stock could yield annual returns of 28.9%, surpassing the previous model’s outlook.

My revenue estimates with the net income margins analysts expect

In the final model, I will use my own estimates but employ the net income margins from the first model, which are lower than those used in the second model.

| Net income Margin | |

| 2023 | 4.8% |

| 2024 | 5.2% |

| 2025 | 5.7% |

| 2026 | 6.3% |

| 2027 | 7.0% |

| 2028 | 7.7% |

As you can see, according to analysts, AMD has the potential to provide robust returns. In the near term, the stock could adjust to a fair value of $120.6, an 18.8% increase from the current stock price of $101.5. Looking ahead, a future value of $229.8 suggests the stock could offer annual returns of 25.3%, which is quite appealing.

Risks to Thesis

The primary risk associated with this thesis, as you may have observed, is AMD’s vulnerability to experiencing negative net income. Nevertheless, it’s worth noting that the company boasts minimal debt and substantial cash reserves when compared to its total debt burden.

The second risk, as previously mentioned, revolves around my belief that the semiconductor market, while recovering from a slump in sales, remains susceptible to another downturn, particularly when an economic downturn commences. In the present environment, this downturn could be exacerbated by factors such as student loan repayments and increases in interest rates, potentially leading consumers into significant debt and, in turn, prompting cutbacks in consumer electronic purchases. As previously noted, this segment accounts for a substantial portion of the world’s semiconductor consumption, exceeding 40%.

The final risk is contingent on AMD’s ability to successfully penetrate the AI-centric data center market. Failure to do so could result in a significant reduction in AMD’s projected valuation as indicated by these models. However, it’s worth recognizing that companies operating in this space currently enjoy quasi-monopoly status. Furthermore, in the PC and console markets, AMD faces competition primarily from Intel Corporation (INTC).

So What?

As per the three models considered, AMD presently appears to be undervalued. Given that my last estimates are the most conservative, I believe that AMD could offer an 18.8% upside, potentially reaching as high as 24% (as indicated in the first model). Therefore, I am setting a price target of $120.6. The possibility of a 25.3% return on AMD’s stock is quite appealing, especially when all three models suggest that AMD has the potential to yield returns exceeding 20%. In my view, this positions AMD’s stock as relatively “safer.” Considering these factors, I rate AMD as a strong buy.

Conclusion

In conclusion, AMD’s current valuation has come under scrutiny through the lens of various models and risk assessments. As I’ve explored, the company has displayed impressive growth trends, transitioning from $9.7 billion in revenue in 2020 to $21.8 billion in 2023, marking a remarkable 21% annual growth. Despite this, the journey hasn’t been without challenges, including declining margins and fluctuations in revenue, perhaps linked to the semiconductor industry’s cyclic nature. The significant share of AMD’s revenues tied to consumer electronics, could further sway the company’s prospects. Nonetheless, AMD’s strong balance sheet, minimal debt, and ample cash reserves serve as a sturdy foundation.

Examining the various valuation models, the consensus indicates that AMD currently remains undervalued. While the models show different potential upsides, even the most conservative estimate suggests an 18.8% upside. This figure could extend to 24% according to other models, setting a price target of $120.6.

With potential returns of over 20% consistently across these models, AMD’s stock appears enticing, making it a compelling investment. In light of this assessment, and considering the range of factors analyzed, it’s reasonable to conclude that AMD is well-positioned, presenting an opportunity for investors. Therefore, I recommend AMD as a strong buy, provided that investors remain vigilant to the ever-evolving landscape of the semiconductor industry.